Well, let’s start off by saying Canada is f@cked.

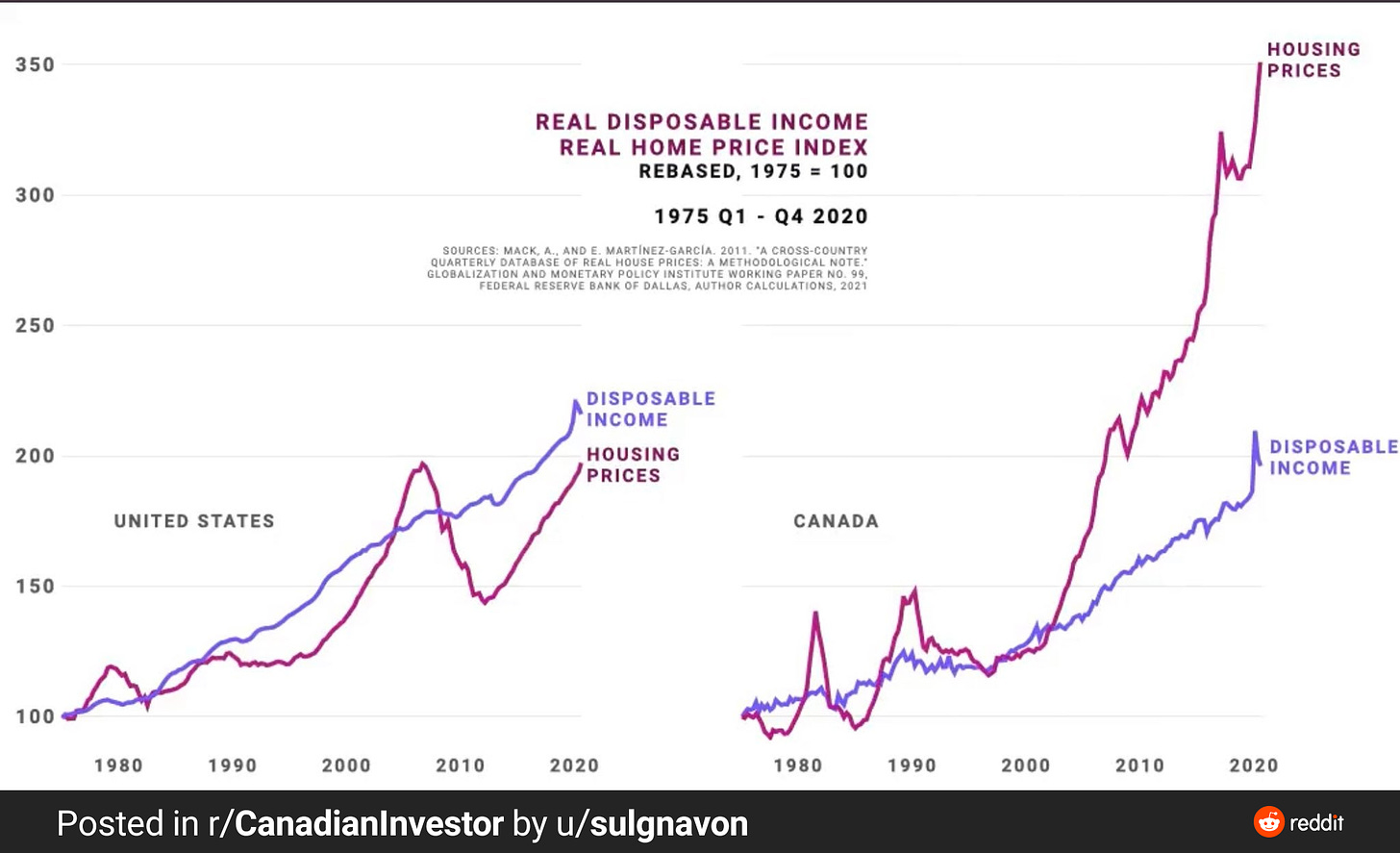

The chart below compares growth of disposable income and housing prices for the US and Canada. One look at the chart and you can see that something is seriously wrong.

The implications are profound. If house prices in Canada don’t decline in a big way, the middle class dream will die. Already, there is evidence that Canada’s largest city - Toronto - is losing it child population. Young Torontonians are postponing or canceling plans to have kids - they simply can’t afford them. And many who do have kids are moving out of the city to afford the extra bedrooms. Unfortunately, all this does is drive up prices for people living in suburbia and small towns, creating a new set of problems.

Families that do have young kids must accept that their children could be living at home forever. That is, unless they’re rich.

Kids that are able to buy homes often get substantial help from their parents. It’s only natural to help your spawn, but this will exacerbate inequality along the lines of familial wealth. If current trends continue for a couple more decades, I wouldn’t be surprised if Canada devolved into a state resembling feudalism.

Of course, nothing is inevitable. A strong middle class is essential for a stable society and most people recognize this. The problem is people lack the political will to do anything about it. A housing crash would be painful for most of the country, leading to unemployment and political turnover. However, a big price decline - and thus increase in affordability - would likely strengthen Canada over the long run.

2: Defensive stocks have outperformed YTD

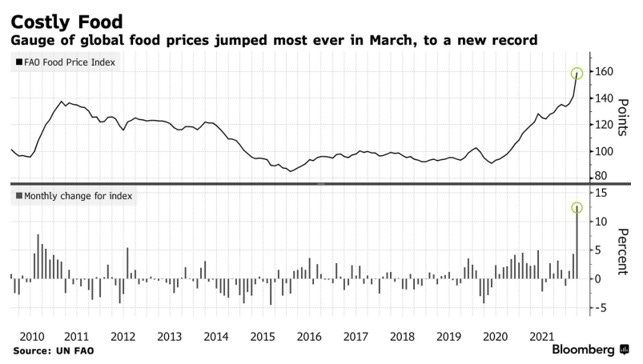

3: Global food prices rose 13% in March alone! This is the fastest increase on record.