Most anticipated recession ever.

The effects of tightening financial conditions are seeping into the real economy.

Restrictive monetary policy and quantitative tightening have dramatically increased the cost of capital for the corporate world. Consequently, lenders are cautious and companies are pausing capital investments and curtailing expenses.

At the same time, a glut of inventory in some sectors is slowing restocking and goods manufacturing.

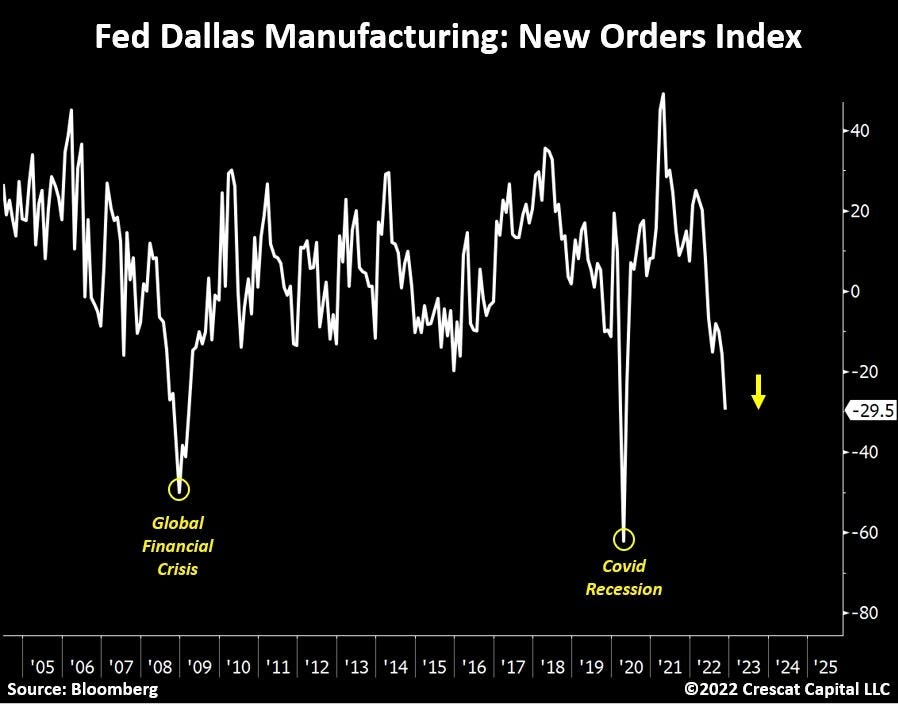

New orders (chart 1) are plummeting, and manufacturing prices (chart 2 and 3) are beginning to adjust. (CPI is also starting to come off its highs, but remains unacceptably elevated.)

As financial and business conditions deteriorate worldwide, global bond markets are now inverted (chart 4). In fact, the global bond market (10yr vs 1-3mth) is more inverted than at any time since 2000.

What does this all spell? R.E.C.E.S.S.I.O.N.

In fact, this seems to be the most widely anticipated recession in history (chart 5).

(Just don’t tell the jobs market yet, as it remains tight. However, I believe hiring appetite has markedly slowed and layoffs are picking up - it just hasn’t shown up in the data yet. Until it does - and until there’s a undebatable decline in CPI - the Fed will continue tightening. In a way the strong employment data is actually helping push us towards recession.)

Chart 1

Chart 2

Chart 3

Chart 4

Chart 5