Beware of the Sucker's Rally

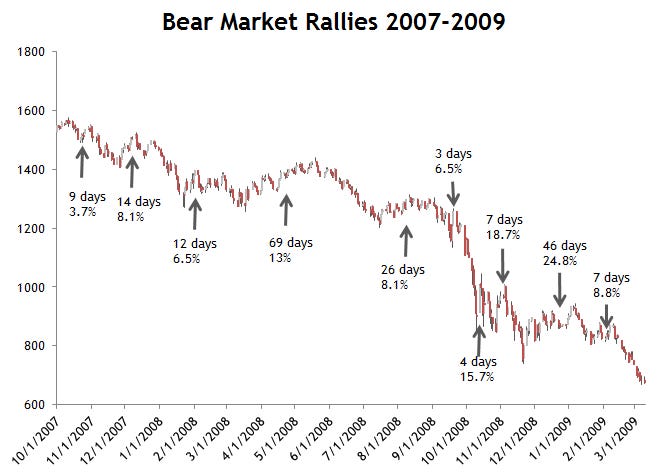

Stocks can experience face-ripping rallies during major bear markets.

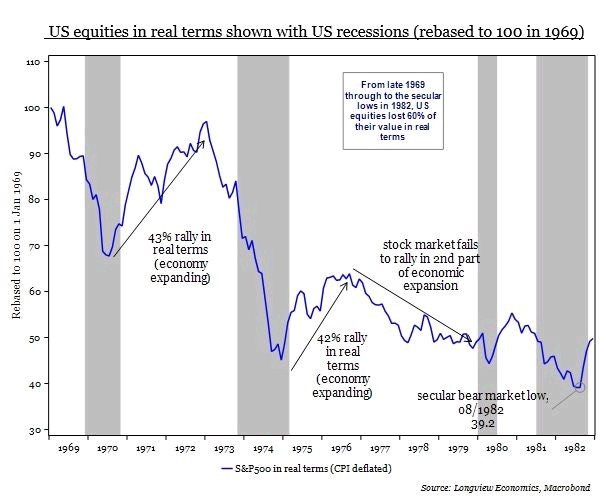

For example, in real terms the S&P 500 rallied 43% and 42% during the 1970s secular bear market. Similar rallies occurred during the Global Financial Crisis, Tech Collapse and Great Depression.

These massive bear market rallies don’t always happen, but when they do they are like a siren’s call.

Bear market rallies are often called ‘sucker’s rallies’ because they attract investors from the sidelines by making them believe the drawdown is over, only to destroy their capital once the bear market resumes.

How will I know when the bear market is over?

Predicting the markets is a fast-moving, ever-evolving game. Forecasts move with data flow, and so do good investors. This is what makes investing an attractive pursuit - it’s not something you ever really master because the dynamics are constantly shifting. I allow evolving data to change my outlook. I never get married to an idea or forecast. Most importantly, I recognize I will be wrong sometimes and budget risk accordingly. Forecasts are fraught with uncertainty.

With that said, the data points I think might paint the picture of a market bottom may include some or all of the following:

Declining inflation (via demand destruction and/or weaker commodity prices)

Declining US Treasury yields

A shift in central bank policy (away from tightening to expansionary)

Significant valuation compression, relative to historical averages, that accommodates potential F23 downward earnings revisions

Daily moves greater than +/- 1% become a rarity

Stock yields converge with 10yr Treasury yields, helping make stocks relatively more attractive

Many retail investors have thrown in the towel

I am not looking for all these things to happen or to happen concurrently. However, I do believe inflation is the number 1 variable to watch. Financial conditions will continue to tighten until inflation is under control.